Key Points

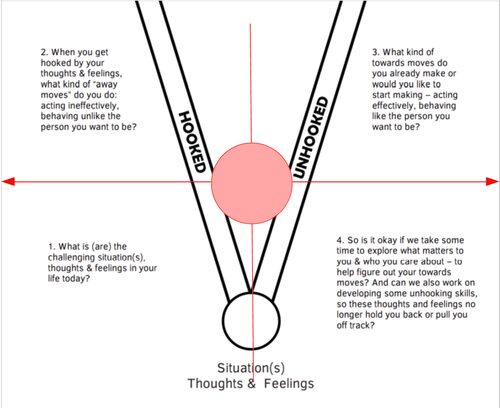

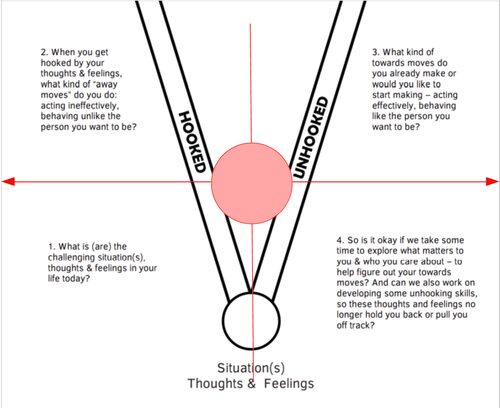

- Hooked Spending: A concept where spending is influenced by emotional desires and immediate gratification. It can lead to a disproportionate share of income being spent on wants and luxuries rather than needs, which can impact long-term financial goals.

- Behavioral Change: Making a conscious effort to understand and modify spending habits can contribute to better financial health. This requires self-awareness, patience, and discipline.

- Understanding Your Spending: By tracking and categorizing expenses into “needs,” “wants,” and “luxuries,” you gain insight into where your money is going and can identify areas for potential savings.

- Distinguishing between Needs and Wants: Recognizing the difference between essential expenses and discretionary spending can help you make informed decisions about where your money is best spent.

- Delaying Gratification: By putting off non-essential purchases, you allow yourself time to decide if these items are truly worth the expense. This waiting period can lead to more thoughtful spending.

- Aligning Spending with Goals: By ensuring your spending habits support your financial goals, you can effectively use your income to support not only your current lifestyle but also your future aspirations.

- Unhooked Spending: This is the practice of conscious, goal-oriented spending that prioritizes needs and true value over immediate gratification. Implementing unhooked spending can lead to increased savings and better alignment with financial goals.

- Progress Wealth Management: We guide and empower you to take control of your finances, aligning your financial decisions with your life goals, to ensure your money works for you, not against you. We believe in transformative financial planning that is genuinely comprehensive and custom to each client.

In the midst of a bustling life, juggling demanding work hours, hobbies, and family time, a sudden realization may hit you like a bolt out of the blue: your money has wings.

Despite a comfortable income, your savings don’t reflect your earnings. Have you ever stopped and wondered why? It boils down to a concept we’ll call “hooked spending.”

Imagine you’re in a guitar shop, admiring an exquisite, handcrafted acoustic guitar. Your fingers itch to strum the strings. It’s a hefty price tag, but you’re not just paying for a musical instrument.

You’re paying for the joy of creating music, the stress relief after a long workday, the bond of jamming with friends.

You’re hooked. And that’s okay.

But there’s a thin line between passion and overindulgence, between needs and wants. Recognizing this line is the first step toward behavior change.

Here’s a story about Dan, a hardworking professional.

Dan had always been a bit of a tech whiz. At a young age, he had a knack for understanding complex systems and breaking them down into simple concepts. This led him down a path where his skillset was not just appreciated, but handsomely rewarded.

Despite his success, something was off. As his income grew, so did his expenses.

His fondness for the newest tech gadgets, the rarest vintage guitars, and exotic travel destinations translated into significant bills. But in the moment, each purchase felt worth it—adding value, joy, or convenience to his life.

It wasn’t until a relaxed Sunday afternoon, while he was reflecting on his life goals, that he realized his finances weren’t aligning with his future. He desired early retirement, but his spending habits told a different story.

He felt a pang of regret, coupled with anxiety about his financial future.

This is where unhooked spending comes into play.

Dan needed to break the cycle.

So, he did something radical. He started tracking his expenses meticulously, categorizing them into “needs,” “wants,” and “luxuries.”

This was eye-opening.

His spending on the latest tech devices and going out to eat alone amounted to 37% of his income. He hadn’t realized the scale until he saw the data.

He started experimenting. He delayed gratification, waiting a couple of weeks before making any “want” or “luxury” purchases. If he still felt the urge after the waiting period, he would go ahead. To his surprise, he found himself opting out of many of these purchases. His savings started to increase.

This behavioral change did more than just boost Dan’s bank balance. It gave him a renewed sense of control and clarity. He felt less financial stress, and his dream of early retirement felt within reach.

The transformation in Dan’s financial health didn’t come from earning more but spending smarter. He still bought tech gadgets and guitars, but only those that he truly valued and not because they were just the latest models or rarest pieces.

Dan’s story is not unique. It reflects the experiences of many high earners who struggle to achieve their financial goals despite substantial incomes.

Embrace the principles of unhooked spending:

- Understand your spending: Awareness is the first step towards change. Track your expenses. You’d be surprised by what you find.

- Distinguish between needs and wants: Identifying necessities from desires is crucial. Not all desires are bad, but distinguishing helps make informed decisions.

- Delay gratification: Pause before buying anything that’s not a necessity. If you still want it after a week or two, go for it.

- Align spending with your goals: Make sure your spending habits support your financial goals. Your future self will thank you for it.

At Progress Wealth Management, we believe in helping you make these transformations. We’re not here just to manage your finances.

We’re here to guide you, to empower you to take control, and to ensure your financial decisions align with your life goals.

Money is a tool. Used wisely, it brings joy, security, and opens doors to experiences. It’s time to unhook your spending and make your money work for you, not against you.